The global container shipping market is undergoing continuous adjustments, influenced by factors such as tariff policies, changes in the sources of goods, and excess capacity. Despite a gradual decrease in the number of cancellations on the main east-west routes, overall capacity remains at a high level.

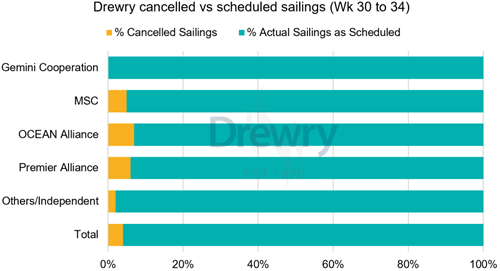

Between weeks 30 and 34, there were a total of 716 sailings, with an expected cancellation of 29 sailings, resulting in a cancellation rate of 4%. The cancellations were predominantly concentrated on the trans-Pacific eastbound route (66%), followed by the Asia to Northern Europe and Mediterranean routes (21%) and the trans-Atlantic westbound route (13%). Simultaneously, the proportion of sailings that were not canceled is increasing, with approximately 96% of sailings expected to proceed as scheduled.

The momentum of U.S. imports is slowing down, with many shippers completing orders ahead of time to avoid tariff risks, leading to a decrease in demand on the trans-Pacific route and exacerbating the downward trend in freight rates.

The Drewry Global Container Freight Index fell by 3% in the week of July 17, dropping to $2,602 per forty-foot equivalent unit (FEU), with a 5% decline on the trans-Pacific route.

Prices on the Asia to Europe and Mediterranean routes remained relatively stable, experiencing only a slight 1% decrease. However, congestion issues in Northern European ports are severe and expected to persist until the end of the peak season.

The trans-Atlantic route is currently stable, but the uncertainty of the United States potentially imposing a 30% tariff on EU goods starting from August 1 may have an impact on future volumes.

Looking ahead, with the imbalance in supply and demand, prices on the east-west routes are expected to continue declining. While shipping companies may respond by reducing capacity, market fluctuations are likely to persist. Shippers are advised to remain flexible, closely monitor market conditions, and adapt to the continuously adjusting shipping environment.