BIMCO's Chief Shipping Analyst, Niels Rasmussen, stated, "We believe that the outlook for container shipping demand remains stable, consistent with our previous assessment. Although the introduction of new trade policies by the United States has brought about uncertainty, it has not altered this outlook. The balance between supply and demand is expected to slightly weaken in 2025 to 2026, mainly because the current ship demand forecast does not include the possibility of the Suez Canal route in the Red Sea returning to normal navigation."

There remains significant uncertainty in the macroeconomic environment, including major trade policy adjustments and ongoing geopolitical tensions that continue to impact market conditions. In April 2025, the International Monetary Fund (IMF) revised down its global economic growth expectations to 2.8% for 2025 and 3.0% for 2026, each being a decrease of 0.5 and 0.3 percentage points from previous forecasts, respectively.

The increase in import tariffs by the United States led to a downward revision in growth expectations for North America, making it the region most visibly affected.

Rasmussen noted, "Despite the weakening economic outlook, global freight volumes grew by 5.1% year-on-year in the first four months of this year, showing strong performance."

The actions of shippers shipping to the United States ahead of potential year-end tariff increases have driven the growth in freight volumes. However, four out of the seven global regions have seen faster growth rates in freight volumes.

Considering the frontloading of North American volumes in the first half of the year, a slowdown in import volume growth is expected in the second half of 2025, leading to a lowering of the annual growth rate expectation. The latest forecasts indicate an average annual growth rate of only 1.6% in import volumes for the region in 2025-2026, the lowest among all regions globally.

At the same time, growth expectations for freight volumes in Europe and the Mediterranean region in 2025 have been raised. The region saw a 7.3% increase in freight volumes in the first four months of this year, with the economic situation continuing to improve. Factors such as declining inflation, reduced interest rates, unemployment rates lower than pre-pandemic levels, and a strengthening Euro are collectively driving the economic prospects in this region.

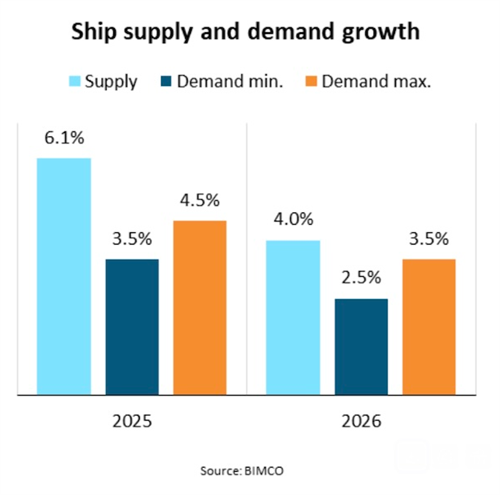

Rasmussen stated, "Overall, the container shipping market faces complex challenges related to trade policies, economic conditions, and geopolitical tensions, leading to significant demand uncertainty. For example, we estimate that ship demand would decrease by 10% if the Suez Canal route in the Red Sea returned to normal navigation. Our baseline forecast indicates a slight weakening of the supply-demand balance in the second half of 2025, leading to a corresponding decline in freight rates. While the relationship between freight rates and supply and demand will deteriorate further in 2026, the extent of the deterioration will be somewhat reduced."