According to the latest data from Alphaliner, the Panama Canal container ship traffic hit a historic high in the first five months of 2025, with over 1200 transits through the locks. This record figure represents a 10.2% increase compared to the same period in 2024 and is 4.1% higher than the peak in the early five months of 2022. Analysis indicates that the growth is mainly driven by the new Panamax vessels ranging from 7500 to 10000 TEU, accounting for over a quarter of the total container ship transits. Alphaliner's data reveals a significant 30.2% year-on-year surge in the transit volume of these vessels from January to May this year.

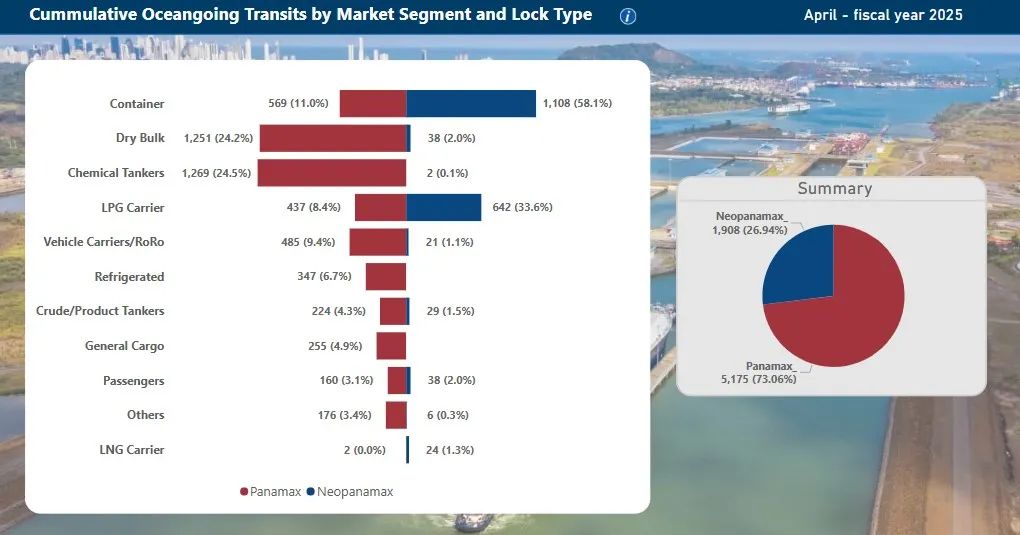

In April 2025, container ships became the most transited vessel type in the Panama Canal, with the new Panamax vessels comprising 58% of the 1677 container ship transits. Bulk carriers, chemical tankers, and liquefied petroleum gas carriers followed closely behind.

In contrast, container ship transits in the Suez Canal have been consistently declining. According to Alphaliner's statistics, vessels over 4000 TEU have become very rare, and in May 2025, the monthly transit volume of new Panamax vessels fell below 100 transits for the first time since July 2024.

The ongoing Red Sea crisis and frequent attacks on merchant vessels by Houthi rebels have led shipping companies to continue bypassing the Suez Canal. Despite the Canal Authority offering rate discounts to attract large container ships back, citing "improvements in regional security situations," most shipping companies still opt for the longer route around the Cape of Good Hope due to security concerns. Although the Suez Canal remains the shortest and most cost-effective passage for the Asia-Europe route, shipping giants like Hapag-Lloyd and Maersk have explicitly stated that they will not resume transits without long-term security guarantees.

Recent adjustments by CMA CGM to the India-Middle East-Mediterranean (MEDEX) route have sparked speculation in the industry about its return to the Red Sea. However, the company continues to operate three weekly services with French naval escort through the risk area, and the latest adjustments only involve route realignment, canceling routes through the Suez in favor of a new route originating from India, without significantly increasing shipping traffic in the Red Sea.