Recently, the liquefied petroleum gas (LPG) shipping market has experienced a strong rebound. Influenced by the ongoing congestion in the Panama Canal, market sentiment has been boosted, vessel supply has further tightened, and there have been significant changes in the global shipping landscape. The Baltic Exchange noted that prolonged delays are leading more shipowners to consider opting for the route around the Cape of Good Hope. This decision will increase the sailing distance for vessels, thereby further tightening shipping capacity.

According to the latest weekly report from the shipbroking firm Fearnleys, if the congestion continues, more and more shipowners may consider choosing the Cape of Good Hope route. Although many vessels have already booked time slots to transit through the canal, some ships are still waiting in ports, with some preparing to participate in auctions for the next transit slot. It is reported that the last auction for priority passage through the canal had a price close to $1 million, and the cost for the next auction is expected to reach a new high.

Data indicates that supported by stable demand from the Middle East and improved market sentiment, the average Time Charter Equivalent (TCE) for Very Large Gas Carriers (VLGCs) on the Middle East to Japan route has risen to $76,115, while due to tight Atlantic supply and the dual impact of delays in the Panama Canal, rates on the U.S. Gulf to Europe route have surged to $94,445 per day.

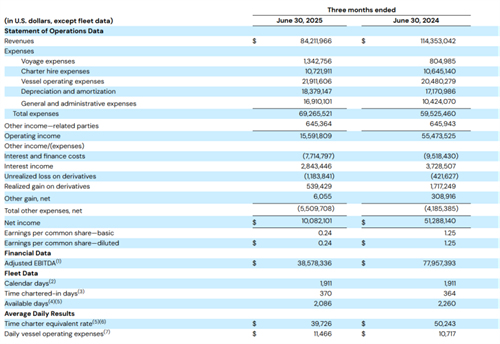

In its second-quarter financial report, U.S. VLGC shipowner Dorian LPG emphasized that adjustments in U.S.-China tariff policies, tensions in the Middle East, and the decreasing transit capacity of the Panama Canal have exacerbated market volatility. Despite moderate import demand and market uncertainties, these factors are contributing to the rise in freight rates.

Although Dorian LPG experienced a decline in operating income in the second quarter, the Chairman, President, and CEO John C. Hadjipateras remains confident in the future development of the LPG market. This confidence is mainly due to the resilience of LPG trade and confidence in the fundamentals. Global LPG shipping volumes grew by 3% quarter-on-quarter and 8% year-on-year in the second quarter, indicating a continuous increase in demand for LPG transportation services.

As of July 31, Dorian LPG owns and operates 26 VLGC vessels, including 20 eco-type VLGCs, 5 dual-fuel VLGCs, and 1 modernized VLGC.